August 9, 2024

“The price of anything is the amount of life you exchange for it.” Thoreau

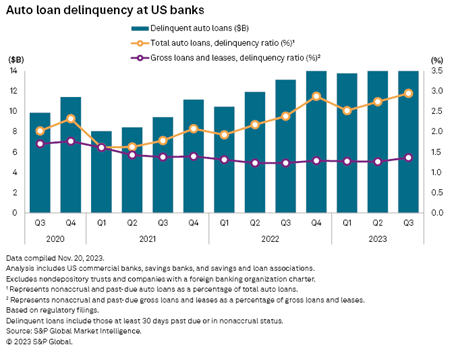

Please note the first quarter 2021 when Biden took office, and also note the steady rise for 3.5 years. Government stimulus checks went to purchase new cars. Inflation caused cars to be more expensive (average price is now $48,000) and also caused interest rates to rise. The average interest rate is 7.3% This year the average new car loan monthly payment is $700, and the average auto loan amount is $40,000.

This situation is being called “sub-prime” exactly like the housing disaster of 2007-2008. Car owners are “upside down” on their car loans. That means they owe more on their cars than the car is worth. And it gets worse. See next graph.

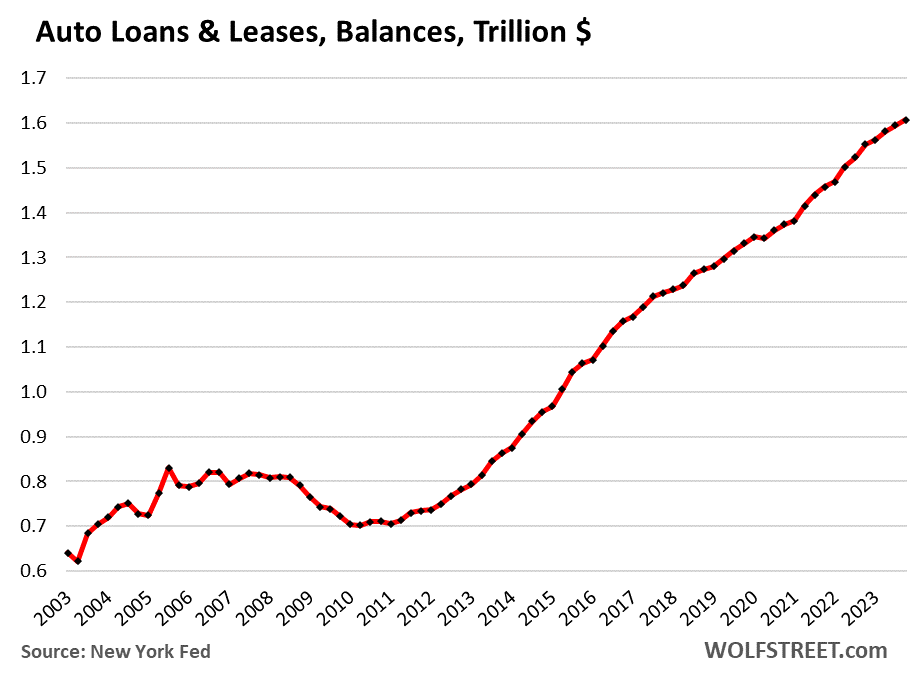

The current auto loan balance in the US is $1.6 trillion. That represents a 100% increase over the last 9 years.

Of course, the result is a record number of repossessions. See data below:

US. repossessions by year:

-2021 1,110,000

-2022 1,228,00

-2023 1,500,00

-2024 1,800,00 (estimate)

Interestingly, the Ford F 150 truck and the Honda Civic are the most repossessed vehicles!

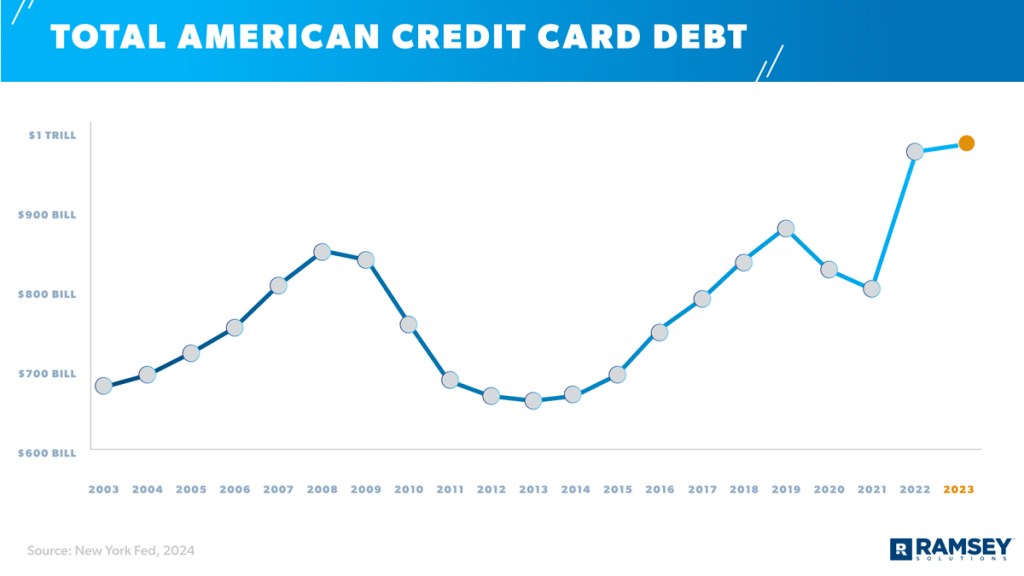

Sadly, and to make matters worse, credit card debt is also at record levels. Americans now owe $1.2 trillion in credit card debt. See below.

US consumers, especially young people, are spending more than they earn and borrowing more than they can afford. Period, and yet, these same people complain about a 7% mortgage rate. Interest rates on credit cards are 22-24%. I hope Powell does not lower the Fed. Res. rates.

PS-Taylor Swift tickets cost $1,100 on average this year, yet her concerts are sold out!!!! A family of 4 would spend $4K on the concert. Pay off the credit card!!