April 12, 2024

“Most men with great wealth have a guilty conscience, I already have a guilty conscience, so I might as well have the money.” Wyatt Earp.

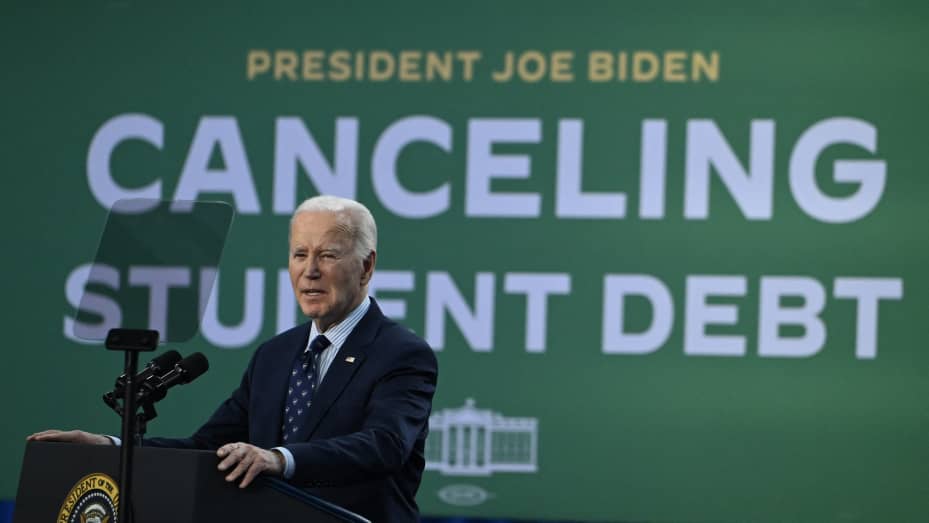

Married couples making $240,000 per year will not have to pay their student debt. Has Biden lost his mind? The average loan payment is about $335/ per month. I bet these people can make their car payments, or did they pay cash?

I am against any form of “relief or forgiveness regarding student debt. Here’s why:

-Half of the current debt (2023) is for master’s degrees and med/law degrees.

-The current average student debt is $35,000. Over 10 years payback is $3,500/year or $300/month. This is not a “crushing amount of debt.” The average price of new car is $47,000. Tesla’s lowest model cost $43,000.

-Biden cannot spend money not authorized by the Legislative Branch. The SCOTUS has already ruled on that. But-forgiving student debt “buys” votes for the Democrats. Give me money and I will vote for you…..

– What about families that saved $$$’s for college? What about students that paid back their debt? Chumps???

-A contract is a contract. Students signed loan agreements and got the funds. Many lived great while borrowing more than they needed. And-many borrowers went to private schools and then complained about the high costs.

-AOC (the fool) says student debt forgiveness will allow these students to “travel aboard.” So-taxpayers should pay for a trip to Europe?

Some students with BA degrees in Liberal arts are having trouble paying their loans. Gender Studies, Art History, Advertising, African Studies, Equity, Social Justice, or French Literature degrees don’t pay well.

-Some research studies have shown families that were impacted by the “sub-prime” mortgage crisis of 2007-2008 (easy credit) are the exact same families whose children are now in debt for school loans. I find that fascinating!

-Why should taxpayers bail out students? What does it teach them????

PS- “My Bad” is not an apology. “I am sorry” is!

My youngest daughter paid off her student loan by working for Vista for over three years. Biden should require this type of service to everyone who cannot pay off their loan. This should be part of the loan agreement. Similar to the Vietnam days in which deferments were given to programs such as the Peace Corps and VISTA. Teacher deferments were also given prior to 1970 when a lottery was installed by the government. The handout Biden is giving out is just another pandering way to keep him in office.

LikeLike

Thanks for the comment. I applaud your daughter. Hope she is well.

LikeLike