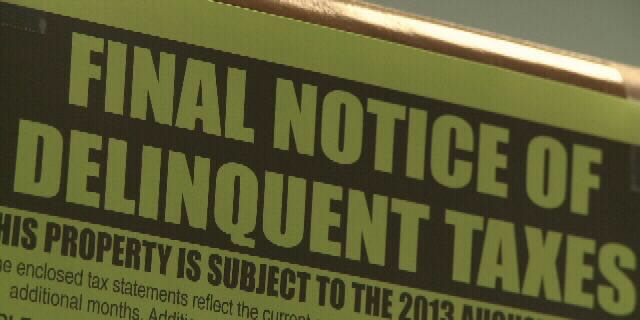

This past Sunday, our local newspaper (The Charlotte Fishwrap) published the names of 50,000+ local people and businesses that did not pay their local taxes. The list was 84 full pages long, using a very small font. The list showed names, addresses and amounts owed. Just assuming each person or business owed $500/each, the total unpaid tax bill would be $25 million. And that is just for the current year, it does not count previous years.

So, I had a variety of thoughts regarding these delinquent taxpayers:

- $25million is a lot of money that could be used for education, law enforcement, road improvements, and resident services.

- Am I a chump for paying my taxes? Ha!

- If personal property taxes like DMV are not paid, are these people still driving legally? Have their driver’s licenses been revoked? How can they afford a car but not the $300 tax?

- Why isn’t the local government collecting from these people and businesses? What is that process? How hard can it be? Does the local budget “allow” for these delinquent payers?

- I guess these people are using local services but not paying for them! The rest of us have to cover their expenses costs.

- What % of these past due amounts does the government collect? I’d like to see that amount, and are there repeat offenders? 50,000 people and businesses is a huge number. How does that happen?

- At $75,000 per teacher, including benefits, the uncollected amount would cover the employment costs for 357 new teachers!!!!

- I say go after these delinquents! Track them down!